Overview

New York, USA

Fintech

SaaS Loan management System

Small & Independent money leaders

Project Background

Our client is a well-established fintech provider known for its wide range of merchant and payment processing services. With years of experience and strong relationships with banks and lenders, they had a front-row view into how lenders operate, including the pain points they struggle with every day.

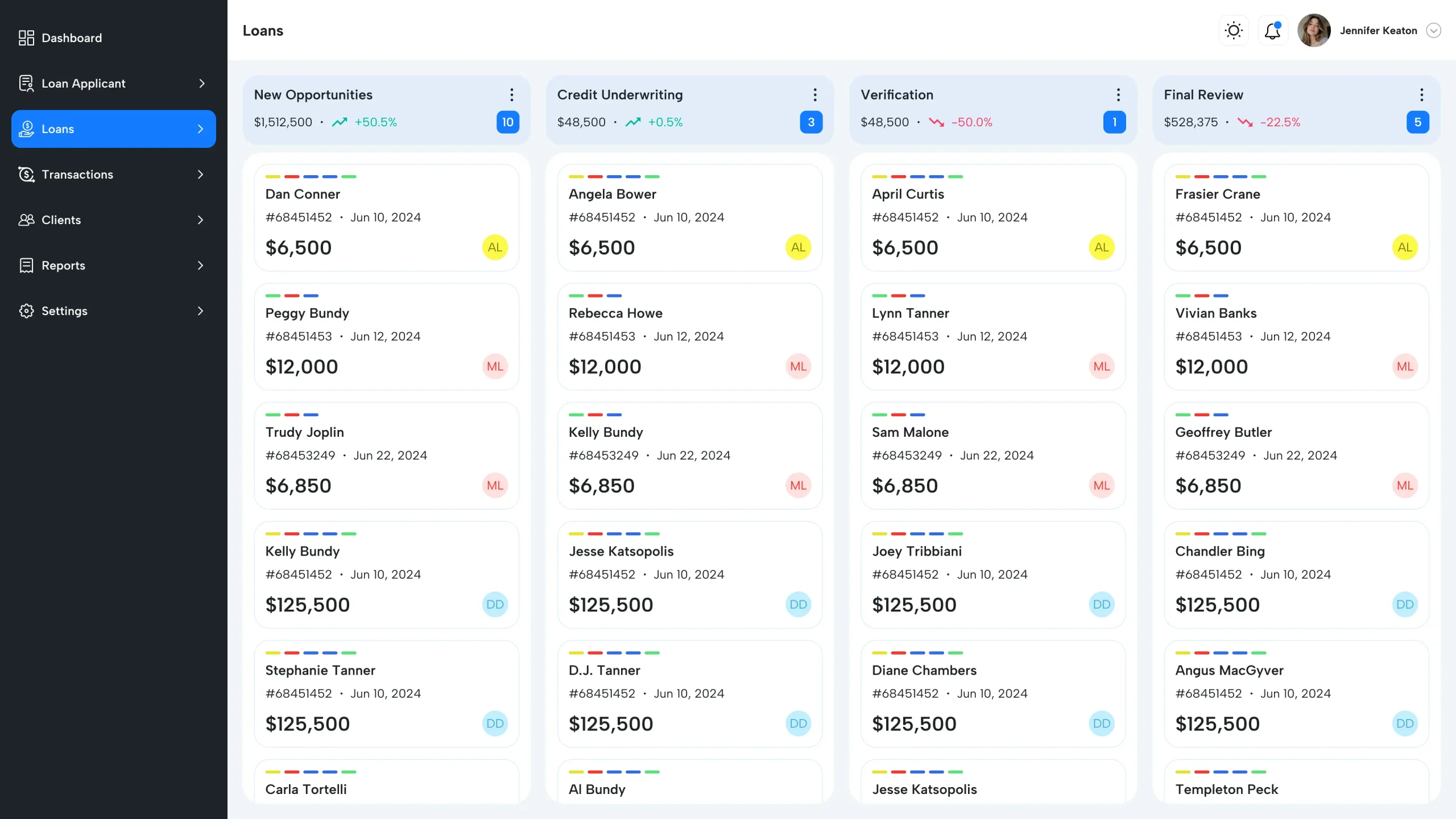

One challenge stood out above the rest: loan management. Payments within lending workflows were scattered, making it difficult to get a clear snapshot of active or past-due loans. Onboarding new customers was slow, and manual processes often led to documentation errors, delays, and heavy administrative workloads.

Our client saw a clear gap in the market. One that they had witnessed firsthand through their own clients’ struggles. They wanted to tap into this opportunity and provide a cloud-based loan management system that could tackle these problems: a platform that combined the ease of use with powerful features to tackle the industry’s most pressing issues head-on.

TOPS strategies in action

When the client approached us with their vision, we knew we didn’t want to build just another software, but to translate the lender’s pain points into a scalable digital-first solution. We worked closely to understand their workflow expectations, pain points, and compliance needs.

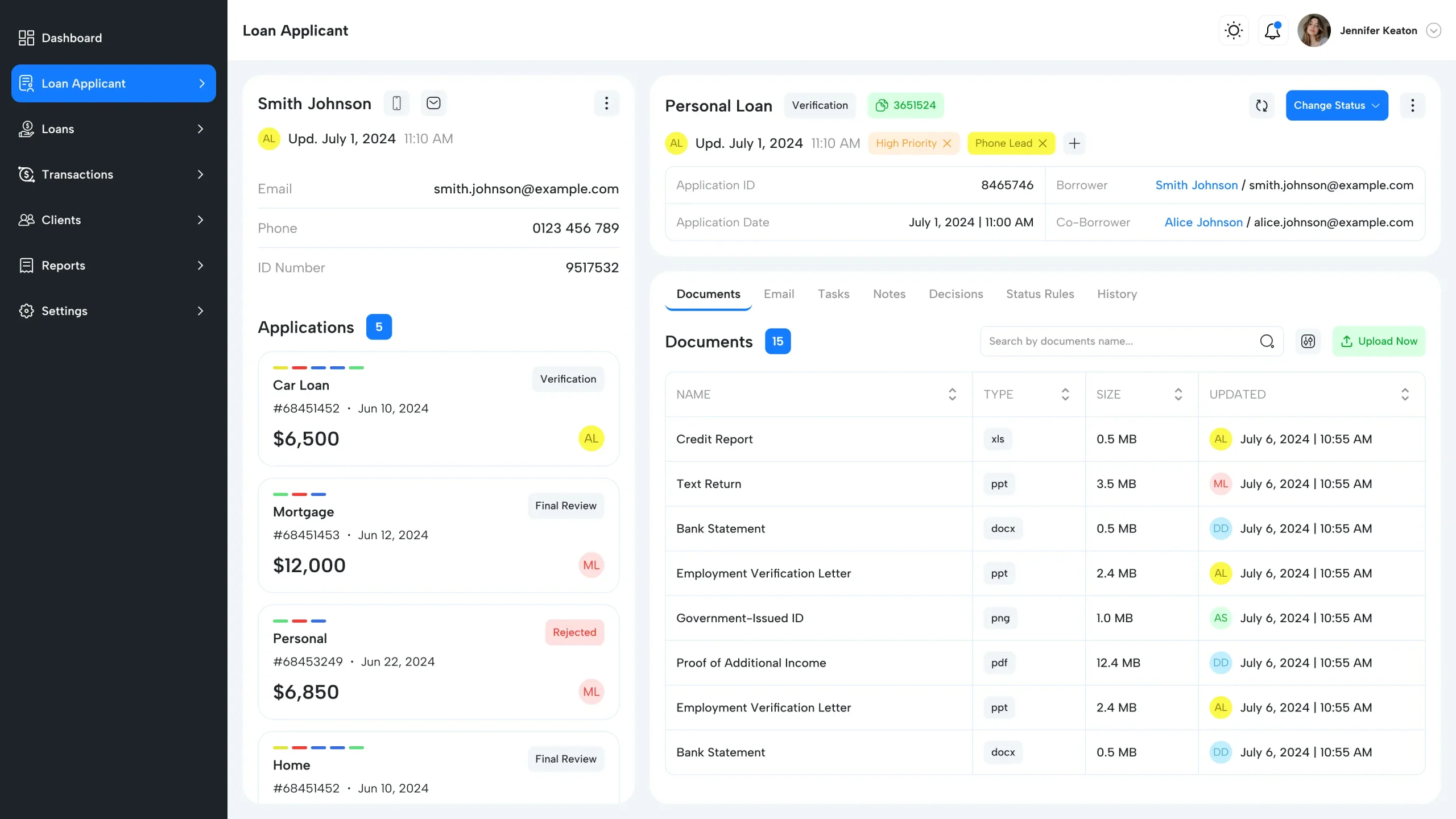

Mapping the lender journey – We began with in-depth discussions with the client to understand how small lenders and banks actually operate. What are their primary touch points? How do they capture leads? How do they close loans? What are the payment processes they use? Knowing these answers helped us identify repetitive tasks and note where manual errors and compliance risks can occur.

Prioritising primary features – Through brainstorming, we defined some non-negotiable functions of the loan management solution.

- User-friendly interface for a design that the lenders don’t find intimidating.

- Automation for eliminating repetitive tasks like automating loan tracking, bank verifications, which are critical but time-consuming.

- Seamless integration with third-party tools like banks, CRM, and payment processors, to have a unified experience of loan management.

Choosing the right tech stack – We provided end-to-end consultation and development services, using a modern tech stack including Laravel 9, Livewire 2, and PostgreSQL to deliver a robust and scalable platform. With that, we first categorized the major bottlenecks that the client wanted to address.

Challenges: What wasn’t working

Loans mean endless paperwork. On the surface, the lending workflow looked simple: capture a lead, verify documents, approve, disburse, and collect. But the reality was rather daunting. According to the client, small lenders were juggling forms, spreadsheets, email threads, and multiple systems for basic loan management.

- Data was everywhere. But never at a single place – Leads were accumulated in CRMs that many lenders already had in place. The customer documents lived in shared drives, and repayment updates were lying in spreadsheets. Since the data was scattered, it was nearly impossible to get a clear view of a borrower’s journey or the overall loan portfolio.

Without a unified view, lenders were spending more time searching for the right information rather than managing loans. Not to forget that manual management also leads to typos, duplicates, and version confusion. A single missing field and an application is tallied for days.

- Compliance was fragile – With loans, compliance is never an afterthought. While lenders ensured compliance, the process wasn’t efficient. There was information, but it wasn’t audit-ready. Preparing a report meant accumulating details from multiple systems and hoping everything was covered.

- Complex payment processing – For many lenders, managing payments was a headache. Multiple payment methods, different processors, and inconsistent rules for failed transactions created delays, errors, and frustration. Tracking which payments were successful, which bounced, and which needed follow-up was time-consuming

- Time lost on repetitive tasks – For a lot of lenders, this was a major problematic area where a lot of time was spent on tasks, but nothing was actually achieved. Since there weren’t automated methods for overdue payment, expiring IDs, or missing documents, simple follow-ups were a hassle for agents. Tasks like verification and funding collection, and refinancing consumed significant hours. It was necessary to redirect agents’ time to driving revenue rather than administrative work.

Solution: Building a cloud-based loan management solution

Pre-built APIs

Lenders couldn’t afford slow starts. They already had growing customer lists and active loans sitting in CRMs, spreadsheets, or legacy systems. To address this, we built pre-configured APIs that allowed lenders to import customers and loans from any third-party tool, spreadsheets, and ERMs, directly into the SaaS tool.

In practice, this meant a small lender with hundreds of active loans could be fully onboarded in hours instead of weeks. We still kept a manual entry option with a clean, user-friendly interface for day-to-day updates. This eliminated the need for copy-pasting customer information, thereby reducing manual errors.

Flexible, controlled payments

We built payment gateways that were flexible and reliable. Our platform allows lenders to connect with a wide range of payment processors, including Authorize.Net, EFTBOP, EFT Network, Kapcharge, and more.

Lenders can assign different processors to different loan groups or payment types, such as debit cards, checking accounts, or other methods. It gives them the freedom to match their workflow and customer preferences. The system also includes Return Rules, which automatically trigger actions when a payment fails or is returned, reducing manual follow-up and minimizing risk.

Security is built in at every step. The platform is PCI DSS compliant, and annual PCI DSS reviews further ensure that all payment procedures and handling meet the highest industry standards.

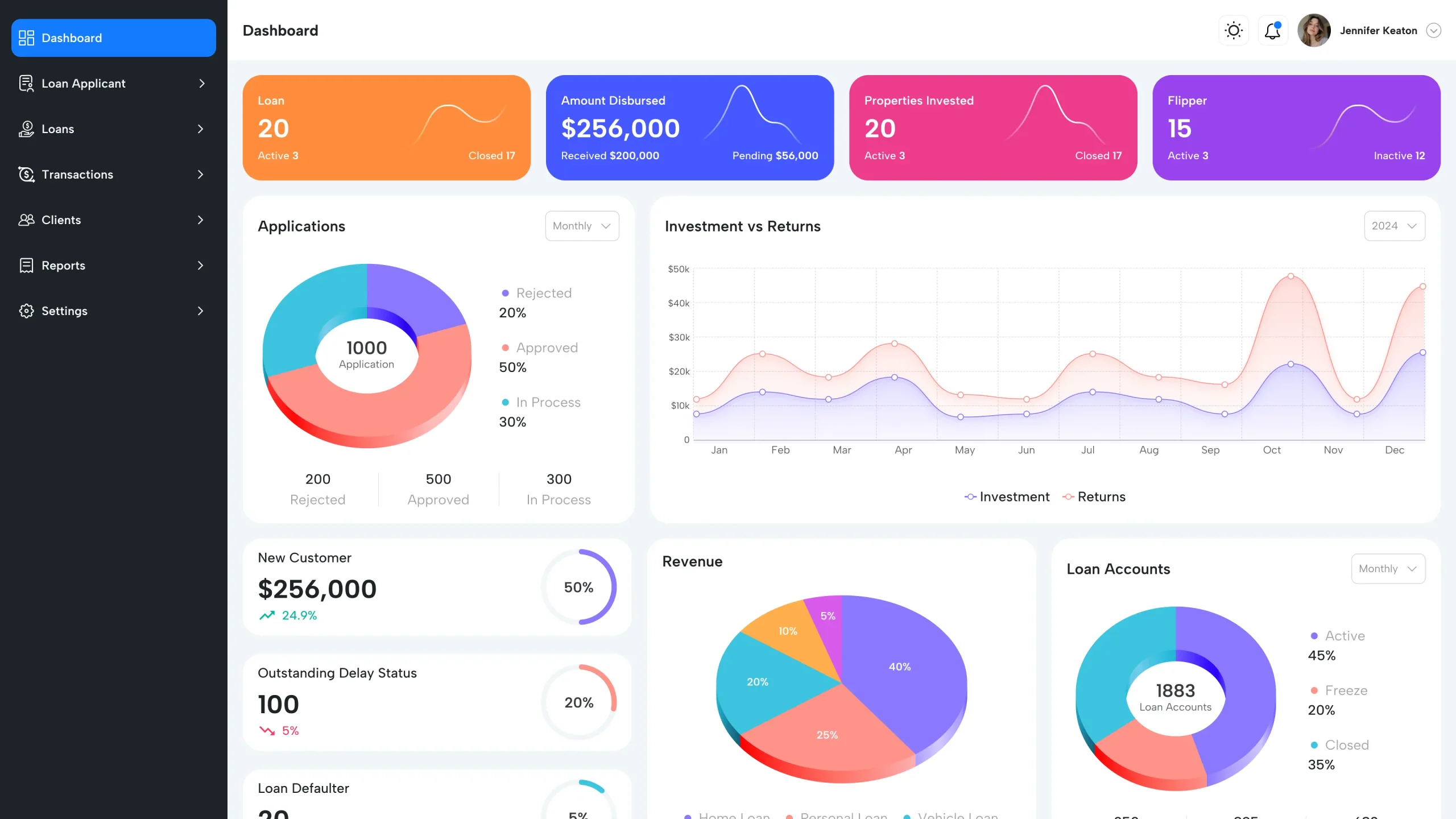

Dynamic Reporting

The client wanted to make reporting accessible for lenders so that they could gain real-time insights into portfolio operations. Instead of piecing together different spreadsheets, they can track new customers, active loans, failed payments, or communications instantly. They can even customize views with filters and columns that can be saved for future use.

Skipped communication logs

Consistent communication is a must for regular payments. If a single mail or message isn’t sent to the receiver, an entire loan cycle is disrupted. To counter this issue, we added a ‘skipped communication log’ where all the scheduled but unsent messages are stored. Looking at these, lenders can contact customers manually if required.

Bulk actions that save time

We built features that allow lenders to maintain multiple loans or customers in one go. Instead of handling one account at a time, lenders can update groups of customers or loans in a single sweep. They can tag, assign admins or collectors, and adjust payments in minutes.

Automation built in

It was critical to integrate automation at every step of the process, be it a new loan application or compliance. Hence, we embedded automation into the workflow. Lenders can now create automated steps for routine yet essential checks in customer loans, like bank verification, adding attachments, and document verification, and set clear triggers for each.

Once triggered, the system executes predefined outcomes, like routing an application for manual verification, flagging a case for review, or moving an approved lead straight into a contract list. For example, if the borrower’s payment fails due to suspected fraud, the system can automatically flag the issue and route the case to the decision cloud for manual verification. Each step is fully automated and traceable, with the flexibility to define outcomes.

Pre-defined Reusable Templates

Loan management also involves a mountain of documentation, reminder messages, and formal agreements. To save lenders from creating these documents from scratch every time (and to keep them consistent across teams), we built a template library right into the platform.

Some of these templates included

- Adjustment (used for adjustment payments)

- Billing statement (used for sending billing data)

- Communication (used for sending email/text messages)

- Contract (used for creating loan contracts)

- Notes (Used for adding comments for the customers)

Customized Roles and Actions

Every customer and loan record field can be customized with tags and loan types that reflect how a lender actually does business. Team management is equally flexible. Lenders can create multiple employee profiles, assign one or more roles to each, and control exactly what permissions those roles carry. Lenders can also tailor the branding, lender pages, event-based notifications, loan types, and even subscription models.

Results: What changed for lenders

After deployment, the platform quickly gained traction and received an exceptionally positive response from lenders.

There was a strong adoption, as within the first year, the platform successfully onboarded over 500 independent lenders and processed more than 2000 loans, with subscriber numbers continuing to grow month over month.

Automation and bulk actions significantly reduced repetitive tasks. Lenders reported that the loan processing times dropped by up to 50% while the daily operational workload decreased. It saved staff hours that were redirected toward customer engagement and growth, along with a 40% reduction in labor costs.

Since compliance was built into the workflow, lenders now operate with confidence. Finally, since the solution was customizable and scalable for growth, it ensured that the system grows with the business, supporting everything from small-scale lending to larger portfolios without adding administrative burden.

Key results

500+

subscribers in 1 year

200+

loans processed

50%

Reduction in Processing Time

40%

Rreduction in labor costs

Looking for Similar Results?

Partner with us to build custom SaaS solutions that streamline workflows, ensure compliance, and scale with your business.